Policy Crossfire: A Dangerous Standoff Between the Fed and the White House

-July 7, 2025

The U.S. economy is entering dangerous territory—not because of poor data, but because of poor coordination between fiscal, trade, and monetary policy. Instead of alignment, we now have a public standoff:

The president is escalating tariffs, triggering a new wave of goods inflation, while the Federal Reserve is resisting calls to cut rates, even though its own models suggest it should—because it doesn’t want to appear politically compromised.

This is not how economic management should work. The Fed's mandate is to manage wage-driven, demand-side inflation, particularly in the service sector—which now makes up the bulk of the U.S. economy. That's why the Fed typically strips out food and energy when assessing core inflation. Yet today, Powell is holding off on cuts not because wages are hot (they're cooling), but because of imported price shocks caused by policy decisions outside his control.

In effect, the Fed is being forced to neutralize inflationary trade policy, even though that’s not its job—and doing so risks choking off growth at a critical point.

Worse, this is happening in the shadow of political tension. The president is publicly pressuring the Fed, while Powell is visibly pushing back—not just to preserve independence, but also to avoid being seen as capitulating. And yet, Powell himself has admitted that rate cuts would be appropriate if not for the inflationary impact of tariffs. This makes the standoff feel more personal than principled. This kind of fragmented policy environment is dangerous. It undermines confidence, distorts signals, and risks tipping the economy into a slowdown that neither side intended.

Market Risk: Euphoria Meets Fragile Foundations

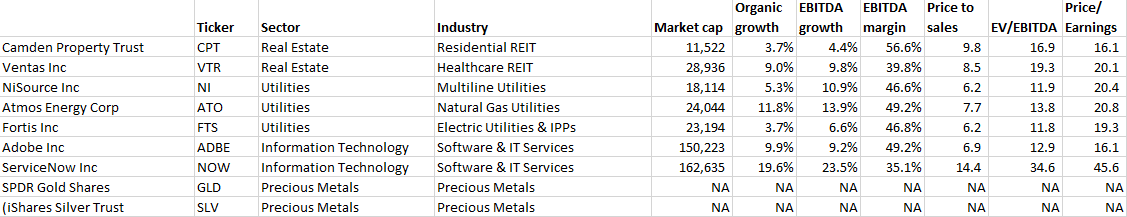

So far, markets have largely shrugged off the risks posed by policy dysfunction. Instead, the narrative has been dominated by excitement around AI-driven productivity, margin expansion, and massive infrastructure investment.

That enthusiasm isn’t misplaced. Companies like Microsoft are already showing tangible signs of transformation: another 9,000 layoffs announced, on top of 6,000 earlier this year, 11,000 in 2024, and 10,000 in 2023. These are not traditional cost cuts driven by weak demand—they reflect an accelerated shift in workforce structure as automation and AI replace or enhance human roles. Microsoft is almost certainly hiring aggressively in parallel—but in different roles, geographies, and functions.

This kind of reshaping is real. It fuels investor optimism and justifies some premium valuations. But in the backdrop of that enthusiasm is a fragile policy environment:

The Fed is holding rates too high, not because of economic strength, but to offset White House-driven inflation from tariffs.

The White House is actively undermining monetary stability, using tariffs as both economic and political weapons. Powell is delaying rate cuts, even though wage inflation has cooled, for fear of looking politically influenced. So far, markets have looked past all of this. But at some point, policy frictions can’t be ignored—especially if growth falters while inflation stays elevated. The longer this standoff lasts, the higher the risk that policy error—not AI—becomes the dominant force in markets.

Policy Critique: When the FBI Investigates Narrative, Not Threat

-July 2, 2025

In a democracy, election integrity must be sacrosanct. Yet recent revelations highlight a dangerous double standard in how our top federal law enforcement agency — the FBI — chooses which threats to pursue and which to suppress.

In 2016, the FBI launched a full-scale counterintelligence investigation based on a vague, secondhand comment by Trump campaign adviser George Papadopoulos to an Australian diplomat. Papadopoulos didn’t allege wrongdoing by the campaign. He merely stated that Russia had obtained damaging information about Hillary Clinton — which later turned out to be true. The “dirt” was emails, leaked via WikiLeaks, that revealed internal DNC bias during the Democratic primary. Troubling? Yes. But it was information. Voters still chose. No ballots were altered, no identities faked.

Fast-forward to 2020. The FBI’s own Albany field office submitted a formal Intelligence Information Report (IIR) based on a confidential human source alleging a foreign plot involving fraudulent U.S. driver’s licenses. These IDs were allegedly being used to allow ineligible individuals to vote — specifically for Joe Biden. That is not information warfare — that is direct interference in the electoral process.

And yet, unlike in 2016, the FBI did not investigate. Instead, headquarters recalled the report — reportedly because it would contradict then-Director Wray’s public statements asserting there was no evidence of foreign interference helping Biden. Even after Albany agents re-interviewed the source and reconfirmed the intelligence, headquarters declined to republish the report. They later instituted a policy that all election-related intelligence must be cleared by HQ — further insulating central leadership from field-based accountability.

This is not about partisanship — it’s about principle. The FBI pursued an investigation that began with political gossip because it fit the prevailing narrative. But when their own agents raised a red flag about a direct assault on the voting process, they buried it. The result is a dangerous precedent: threats that challenge official narratives are sidelined, while politically convenient suspicions are amplified.

If the Bureau will chase leads based on offhand conversation in a London wine bar, it should certainly investigate credible leads from its own field agents — especially when they suggest active attempts to subvert American votes.

This is not a critique of one political party. It is a warning about institutional drift: when truth becomes secondary to narrative, trust in law enforcement dies. A functional democracy needs apolitical institutions that follow facts — even when they’re inconvenient.