AI’s Energy Appetite: Meeting the Demand of the Next Tech Revolution -Jan 2025

The rapid adoption of artificial intelligence (AI) technologies has sparked a dramatic increase in electricity demand, driven primarily by the expansion of data centers. These facilities are the backbone of the digital economy, powering everything from AI training models to cloud computing. As demand grows, so too does the need for substantial investment in power generation and grid infrastructure. Let’s unpack the numbers, estimate the costs, and explore the implications for investors.

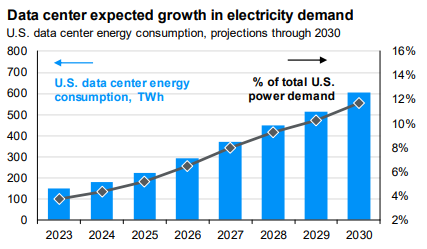

Data centers are energy-intensive, and the rise of AI has only magnified their power requirements. Leading markets like Virginia, Texas, and Ohio have become epicenters for data center development. McKinsey estimates that electricity demand from U.S. data centers will grow by as much as 70 terawatt-hours (TWh) per year adding up to a cumulative increase of 400TWh over the next 5–6 years. To put this in perspective, this growth equates to adding the electricity consumption of several medium-sized cities every year. What's more we believe this marks a sustained increase in the the growth trajectory for power consumption globally for the foreseeable future.

Source: McKinsey, JP Morgan

Meeting this demand will require a 6% increase in U.S. generation capacity, translating to roughly 72 gigawatts (GW) of new capacity. This estimate reflects the combination of renewables and natural gas, with renewables accounting for about 43.2 GW at a cost of approximately $58.3 billion, and natural gas providing 28.8 GW at a cost of $25.9 billion. While these figures are significant, they also illustrate the efficiency gains in renewable energy costs over the past decade, as solar and wind now outcompete traditional generation in many regions. In total, generation investments are expected to reach $84.2 billion, though regional factors like project clustering and transmission availability could drive variability in final costs.

Transmission infrastructure will also need significant upgrades, making it a critical focus area. To connect renewable projects and handle increased grid loads, we estimate 6,600 miles of new transmission lines will be required at a cost of $20.5 billion. The clustering of renewable projects and the shared use of transmission corridors could help optimize costs, but these estimates also include high-capacity lines capable of integrating intermittent renewable energy into the grid. Adding substations and grid integration will contribute an additional $660 million, bringing total transmission costs to $20.5 billion. Altogether, the investment in both generation and transmission infrastructure is projected at $104.7 billion over the next 5–6 years.

The cost of building this infrastructure will be shared among several stakeholders. Utilities will finance much of the generation and grid upgrades, passing costs to customers through rate increases. Large data center operators like Amazon, Google, and Microsoft are also investing directly in renewable energy projects to power their operations sustainably. Federal and state incentives, such as tax credits from the Inflation Reduction Act, will offset some of these costs. Additionally, public-private partnerships, green bonds, and private equity are expected to play a significant role in funding these projects.

As for the energy mix, solar and wind are expected to dominate new generation due to their alignment with corporate sustainability goals and public policy incentives. Natural gas will remain essential for grid reliability, particularly during periods of high demand or low renewable output, though its role will likely diminish as storage technologies improve.

This transformation presents a range of investment opportunities. Renewable energy providers like NextEra Energy (NEE) and Brookfield Renewable Partners (BEP) are well-positioned to benefit. Utility companies such as Dominion Energy (D) and American Electric Power (AEP) will play a critical role in upgrading grids and adding capacity. Fortis (FTS), which owns ITC Holdings and significant transmission assets across the U.S., positioning it as a major beneficiary of these developments. Firms specializing in grid construction and high-voltage transmission, like Quanta Services (PWR), are likely to see significant demand. Energy storage companies like Tesla (TSLA) and Enphase Energy (ENPH) will be key players in balancing intermittent renewables. Additionally, data center real estate investment trusts (REITs) such as Digital Realty Trust (DLR) and Equinix (EQIX) stand to benefit from the expansion of facilities.

AI and data center growth are reshaping the U.S. energy landscape, pushing the boundaries of what the grid can deliver. Meeting this rising electricity demand will require an estimated $100 billion in investments over the next 5–6 years. With a balanced mix of renewables and natural gas, and the rapid pace of grid innovation, this transformation represents one of the most significant opportunities of our time. Investors who align with these shifts stand to benefit as the energy sector powers forward into a new era defined by AI-driven growth.

Disclaimer:

This note is provided for informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect the views of any affiliated entities. Investors should perform their own due diligence or consult with a financial advisor before making any investment decisions. The specific securities and investments mentioned are discussed solely for illustrative purposes and should not be considered an endorsement or a recommendation to buy or sell any security. The information provided is based on publicly available data as of the date of publication and is subject to change.

Further reading:

https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capcost_assumption.pdf

https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

https://www.energy.gov/policy/articles/clean-energy-resources-meet-data-center-electricity-demand